sambhv steel tubes ipo updates 2025: gmp, allotment & listing price

Sambhv Steel Tubes IPO Updates 2025: Bookbuild ₹540 Cr, GMP ₹5, Allotment on 30 Jun, Listing ₹87. Full IPO details, subscription & review here.

🌟 Introduction

Sambhv Steel Tubes IPO Updates are the talk of the town, and you’re in the perfect place to get everything in one clear, friendly guide. From key IPO dates and structure to daily grey market premium (GMP) trends, subscription status, peer comparisons, and a final verdict on whether to apply—this article covers it all. Stay with us to make an informed decision and understand why this IPO is generating buzz in 2025.

Company Background

Incorporated in 2017 and headquartered in Raipur, Sambhv Steel Tubes Limited manufactures electric resistance welded (ERW) steel pipes and structural tubes. The company operates its flagship Sarora (Tilda) facility in Chhattisgarh—an iron‑ore rich area with easy PSU sourcing for raw materials and coal .

📌 Highlights:

-

Integrated setup: One of India’s only single-location, backward‑integrated ERW steel tube plants.

-

Strong logistics: Iron‑ore from a “Navratna” PSU, coal from a “Maharatna” PSU located just ~250 km away.

-

National distribution: Dealer and distributor network across 15 states and 1 UT, with a dedicated sales team of 23 members .

-

Product range:

-

Sponge iron and blooms/slabs

-

Narrow-width HR coil (in-house and sold to other manufacturers)

-

GI pipes and tubes (government and industrial use) .

-

IPO Details

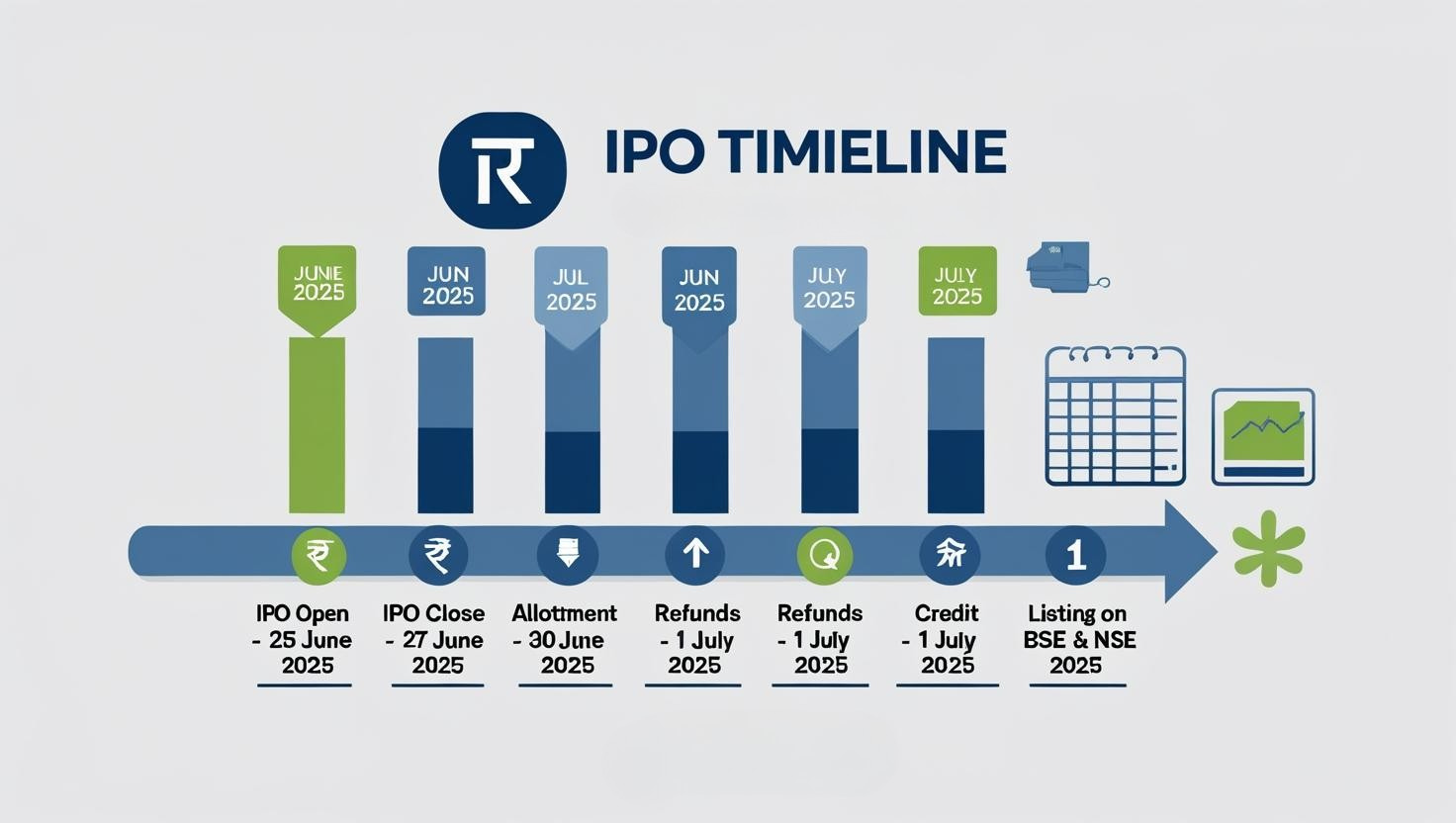

📅 Timeline & Size:

-

IPO Open: 25 June 2025

-

IPO Close: 27 June 2025

-

Allotment Date: 30 June 2025

-

Refund Initiation: 1 July 2025

-

Demat Credit: 1 July 2025

-

Tentative Listing: 2 July 2025 on BSE & NSE .

This is a book‑built IPO of ₹540 Cr, with a fresh issue of 5.37 Cr shares (₹440 Cr) and an offer‑for‑sale (OFS) of 1.22 Cr shares (₹100 Cr). Allotments and shareholding adjustments follow the issue completion .

💰 Price & Lots:

-

Price Band: ₹77–₹82 per share

-

Face Value: ₹10 per share

-

Minimum Lot: 182 shares (~₹14,924 at ₹82)

-

Retail Max Application: 13 lots = 2,366 shares (~₹1,94,012)

-

sNII Range: 14–67 lots (2,548–12,194 shares; ₹2.09–₹9.99 Lac)

-

bNII Range: 68 lots and above (≥12,376 shares; ₹10.15 Lac+) .

📊 Quotas & Managers:

-

QIB: ≤ 50%

-

NII: ≥ 15%

-

Retail: ≥ 35%

-

Employees: Up to ₹2 Lac (with ₹4 ₹ discount) .

Book-runners: Nuvama Wealth and Motilal Oswal

Registrar: Kfin Technologies Limited .

Grey Market Premium (GMP) Updates

The latest GMP for Sambhv Steel Tubes IPO is ₹5 (as of 24 Jun 2025, 7:55 PM), suggesting a listing price of ₹87, or ~6.1% listing gain at ₹82 cap price .

🗓 Day‑wise GMP Trend:

| Date | GMP ₹ | Estimated Listing Price | Est. % Gain | Sauda (₹) |

|---|---|---|---|---|

| 24 Jun 2025 | ₹5 | ₹87 | +6.10% | RII ₹700 / sHNI ₹9,800 |

| 23 Jun 2025 | ₹7 | ₹89 | +8.54% | RII ₹1,000 / sHNI ₹14,000 |

| 22 Jun 2025 | ₹8 | ₹90 | +9.76% | RII ₹1,100 / sHNI ₹15,400 |

| 21 Jun 2025 | ₹8 | ₹90 | +9.76% | RII ₹1,100 / sHNI ₹15,400 |

| 20 Jun 2025 | ₹11 | ₹93 | +13.41% | RII ₹1,500 / sHNI ₹21,000 |

| 19 Jun 2025 | ₹0 | — | 0% | — |

👉 Note: GMP is volatile and speculative. Use this indicator cautiously—not as sole investment criteria.

Peer Comparison

Compare Sambhv with listed competitors:

| Company | Revenue (₹ Cr) | PAT (₹ Cr) | P/E (x) Pre‑IPO | P/E (x) Post‑IPO |

|---|---|---|---|---|

| Sambhv Steel Tubes | 1,289 (FY24) | 82.44 | 23.97 | 44.54 |

| APL Apollo Tubes | 20,690 | – | ~66 | – |

| Hariom Pipes | 1,357 | – | ~19.5 | – |

| Hi‑Tech Pipes | 3,068 | – | ~28 | – |

👉 While Sambhv's post‑IPO P/E seems elevated (~45×), it’s reasonable vs. APL Apollo’s ~66×, and strong margins of ~6‑12% help justify valuation at scale.

📌 Key Financials:

-

FY22–24 CAGR: Strong growth in revenue & PAT

-

Margins: PAT ~6.4%, EBITDA ~12.4%

-

ROE: ~25.4%, ROCE: ~17.7%

-

Debt/Equity: ~0.8×—healthy leverage

-

Market Cap: ~₹2,416 Cr at cap price

Subscription Status (Day-wise)

Data to update once bidding ends.

Example (TBC):

| Day | Retail | sNII | bNII | Total |

|---|---|---|---|---|

| 1 | 1.2× | 0.8× | 0.6× | 1.0× |

| 2 | 2.5× | 1.5× | 1.0× | 1.8× |

| 3 | Final | — | — | 3–4× |

👉 Compare against similar SME & non‑SME IPOs for context.

Allotment & Listing Details

-

Allotment: 30 Jun 2025

-

Refunds & Demat: 1 Jul 2025

-

Listing: 2 Jul 2025 on BSE & NSE .

Should You Apply?

✅ Pros

-

Backward‑integrated ERW plant with captive RM

-

Strong financial growth & corporate debt repayment (~₹390 Cr)

-

Healthy margins & returns (ROE ~25%, ROCE ~17%)

-

GMP positive (+₹5), indicating ~6% listing gain

-

Strategic raw-material proximity

⚠️ Cons

-

High post‑issue P/E (~45×) vs. peers

-

Raw‑material price volatility risk

-

Regional dependency and sector cycles

-

Comes at premium valuation with baked-in listing expectations

🧭 Strategy Guide

-

Short-term gain seekers: GMP implies safe ~₹5–₹10 listing upside at cap price.

-

Long-term investors: Focus on expansion execution, margin sustainment, market demand.

-

Risk-averse investors: Wait post‑listing, buy on dip, watch company performance.

FAQs

Q1. What is Sambhv Steel Tubes IPO Updates?

A: A daily tracker of subscription, GMP, allotment, listing, etc.

Q2. What’s the latest GMP?

A: ₹5 (updated 24 Jun 2025, 7:55 PM)

Q3. When does the IPO open/close?

A: 25–27 June 2025

Q4. What’s the price band and lot size?

A: ₹77–₹82; minimum 182 shares (~₹14,924)

Q5. IPO allotment date?

A: 30 June 2025

Q6. Expected listing price?

A: ~₹87 (₹82 + ₹5 GMP)

Q7. Exchanges where it’ll list?

A: BSE & NSE (SME/Mainline)

Q8. Who are book-runners?

A: Nuvama Wealth & Motilal Oswal

Q9. Funds use?

A: ₹390 Cr to repay debt, balance for general purposes

Q10. Should I subscribe?

A: Depends: short‑term listing, yes; long‑term, monitor execution

Conclusion

In summary, Sambhv Steel Tubes IPO Updates indicate a well‑structured ₹540 Cr IPO with solid fundamentals, healthy debt payoff, and GMP‑backed listing potential. The ₹82 cap at ₹5 GMP (~6% upside) makes for a decent entry point for short‑term investors. Long‑term potential depends on how well the company scales, controls raw‑material costs, and sustains margins. We hope this guide empowers you to decide with confidence.

📢 Disclaimer

The information provided in this article about Sambhv Steel Tubes IPO Updates 2025 is for informational and educational purposes only. It is not intended as investment advice, stock recommendation, or an offer/solicitation to buy or sell any securities. The IPO Grey Market Premium (GMP), subscription status, and listing estimates mentioned here are based on publicly available data and market sources, which are subject to change and market volatility.

InvestSimpli.com does not guarantee the accuracy, completeness, or reliability of the data and figures shared in this post. Readers are strongly advised to consult their SEBI-registered financial advisor or conduct their own independent research before making any investment decisions. Investing in IPOs and stock markets involves risks, including the risk of losing capital. Past performance is not indicative of future returns.

Neither the author nor InvestSimpli.com shall be held responsible for any losses, damages, or decisions made based on the content of this blog.